Contents:

In this article, you will learn about managing current assets that act as a source of short-term finance for your business. Further, you will also learn what is Net Working Capital and how to calculate Net Working Capital. The owner has $1.20 in current assets for every $1 of current liabilities.

Money is coming in and flowing out regularly, giving the business flexibility to spend capital on expansion or inventory. A high ratio may also give the business a competitive edge over similar companies as a measure of profitability. We can see in the chart below that Coca-Cola’s working capital, as shown by the current ratio, has improved steadily over the last few years. It represents a company’s liquidity, operational efficiency, and short-term financial health. Therefore, at the end of 2021, Microsoft’s working capital metric was $96.7 billion. If Microsoft were to liquidate all short-term assets and extinguish all short-term debts, it would have almost $100 billion of cash remaining on hand.

Working Capital vs. Fixed Assets/Capital

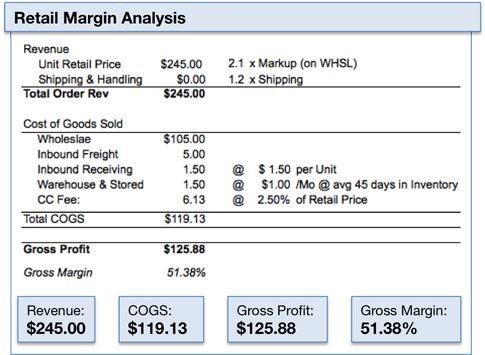

Subtract the latter from the former to create a final total for net working capital. If the following will be valuable, create another line to calculate the increase or decrease of net working capital in the current period from the previous period. On the other hand, a ratio above 1 shows outsiders that the company can pay all of its current liabilities and still have current assets left over or positive working capital.

The desirable situation for the https://1investing.in/ is to be able to pay its current liabilities with its current assets without having to raise new financing. Working capital refers to the difference between current assets and current liabilities, so this equation involves subtraction. The net working capital ratio, meanwhile, is a comparison of the two terms and involves dividing them. The ratio suggests the company’s ability to meet its operating expenses from the gross revenue. However, it doesn’t consider that all expenses and revenues might not affect cash flows.

Turnover ratios for Checking the Company’s Efficiency in Generating Sales

A high working capital ratio means that the company’s assets are keeping well ahead of its short-term debts. A low value for the working capital ratio, near one or lower, can indicate that the company might not have enough short-term assets to pay off its short-term debt. This current ratio shows how much of your business revenue must be used to meet payment obligations as they fall due. And, as a consequence, it shows you how much you have left to use for new opportunities such as expansion or capital investment.

- These companies need little working capital being kept on hand, as they can generate more in short order.

- For example, Microsoft’s working capital of $96.7 billion is greater than its current liabilities.

- Investopedia requires writers to use primary sources to support their work.

- Negative working capital means assets aren’t being used effectively and a company may face a liquidity crisis.

- Therefore, financial managers must develop effective working capital policies to achieve growth, profitability, and long-term success.

Self-Employed The tools and resources you need to run your own business with confidence. Midsize Businesses The tools and resources you need to manage your mid-sized business. Your Guide to Growing a Business The tools and resources you need to take your business to the next level. Your Guide to Running a Business The tools and resources you need to run your business successfully.

Working Capital: The Quick Ratio and Current Ratio

The working capital ratio provides you with a good look at the total liquidity of your business for the upcoming year. When faced with bad debts, your business needs to know it can count on an insurance safety net. Learn how our experts handle claims swiftly and smoothly, from filing to indemnity payment.

These ratios are the best tools for assessing your progress and increasing working capital. There are plenty of ratios and metrics you can use to perform analysis, but working capital should be at the top of your review list. The tools and resources you need to take your business to the next level. The tools and resources you need to get your new business idea off the ground. Multimedia Hub Listen to the Mind the Business podcast by QuickBooks and iHeart.

Business Cards

For example, imagine a company whose current assets are 100% in accounts receivable. Though the company may have positive working capital, its financial health depends on whether its customers will pay and whether the business can come up with short-term cash. When a working capital calculation is negative, this means the company’s current assets are not enough to pay for all of its current liabilities. The company has more short-term debt than it has short-term resources. Negative working capital is an indicator of poor short-term health, low liquidity, and potential problems paying its debt obligations as they become due.

What Is Working Capital? Definition, Formula & Importance – TheStreet

What Is Working Capital? Definition, Formula & Importance.

Posted: Fri, 13 Jan 2023 08:00:00 GMT [source]

The ratio between 1 and 2 indicates that the company is running the business smoothly and will help in increasing the growth of the business. Working capital meaning is the difference between the funds received from the debtors and the funds that need to be paid to the creditors. A higher working capital cycle may push the company for taking short-term loans to fund its working requirement and a short-term loan generally comes at a higher rate of interest. So the alternate method to raise funds for running the daily business of a company can bring in some discounts on products or generate cash by giving some offers to the clients.

Working Capital Turnover Ratio Calculator

However, a very high financial accounting vs managerial accounting ratio may point to the fact that a company isn’t utilizing its excess cash as effectively as it could to generate growth. A company can also improve working capital by reducing its short-term debts. The company can avoid taking on debt when unnecessary or expensive, and the company can strive to get the best credit terms available.

Short-term investments can be utilized when there is a requirement for additional liquidity within the business due to a spike in current liabilities. It helps the finance managers determine the company’s financial sustainability by comparing the annual operating expenses against the gross annual revenue. The lower the ratio, the higher the level of financial sustainability since it would mean that fewer revenues are being used to meet the expenses.

The deceptively simple working capital number or ratio can provide a lot of information about your business, particularly how it will fare throughout the current fiscal year. Your working capital provides you with the information you need in order to know whether you’ll be able to fulfill all of your financial obligations for the upcoming year or need to make changes. As with other performance metrics, it is important to compare a company’s ratio to those of similar companies within its industry.

Longer the cycle, the longer the business has its funds utilized as working capital without earning a return. Accounts ReceivablesAccounts receivables is the money owed to a business by clients for which the business has given services or delivered a product but has not yet collected payment. They are categorized as current assets on the balance sheet as the payments expected within a year. Cash And Cash EquivalentsCash and Cash Equivalents are assets that are short-term and highly liquid investments that can be readily converted into cash and have a low risk of price fluctuation. Cash and paper money, US Treasury bills, undeposited receipts, and Money Market funds are its examples.

Since the working capital ratio measures current assets as a percentage of current liabilities, it would only make sense that a higher ratio is more favorable. This means that the firm would have to sell all of its current assets in order to pay off its current liabilities. The reason this ratio is called the working capital ratio comes from the working capital calculation. When current assets exceed current liabilities, the firm has enough capital to run its day-to-day operations.

Recent Comments